According to Brad Feld, the essential activities of entrepreneurship are linked to the formation of startups and the growth of companies. As startup founders maneuver the growth journey from formation and business model realization through achieving traction and product/market fit to a stage when the focus shifts to market expansion and company growth, their needs, opportunities and challenges vary. Such startups are becoming scaleups. And scaleups play a vital role in the startup community, as mentors, motivators and investors. Finding a balance between the creation of new startups and scaleups is essential for the overall health of the ecosystem.

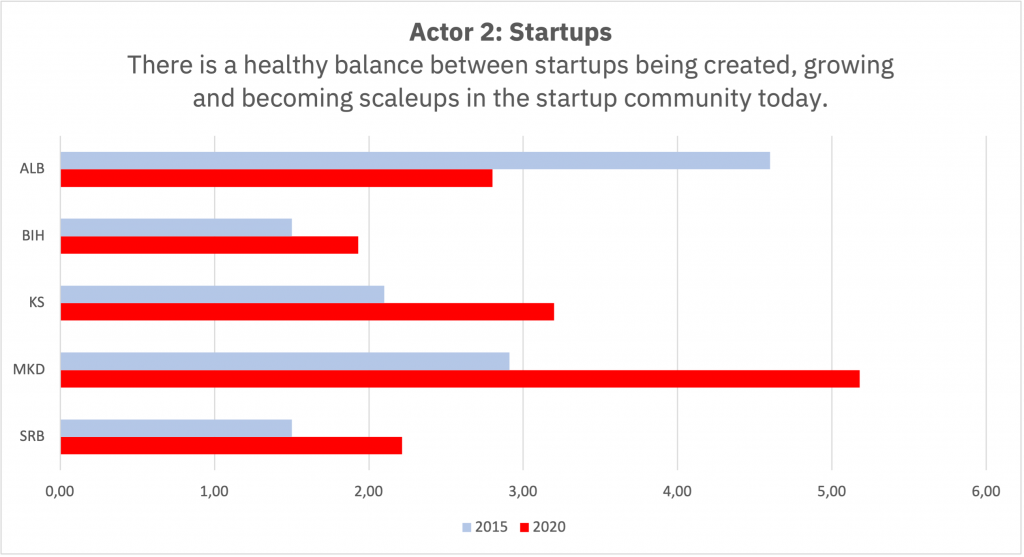

To further explore this topic, we asked our interviewees how accurate they found the following statement “There is a healthy balance between startups being created, growing and becoming scaleups in the startup community today.”

The unreserved response was no! The interviewees did not find the statement accurate, and one went so far as stating that “there is no balance at all”. However, a historical comparison calls for some optimism. In 2015, the score was 2.4 (on a scale from 0 to 10), meaning there was almost complete disagreement with the statement. Five years later, the score is 3.2, which still represents an improvement of 33%.

Again, the scoring varies greatly from country to country. The balance between startups and scaleups appears to be improving in four of the five countries to various degrees – Albania (+64%), Bosnia & Herzegovina (+27%), North Macedonia (+79%) and Serbia (+47%). However, in Kosovo (-36%), the interviewees declared that things were moving in the opposite direction and there was more balance between startups and scaleups five years ago. This result is most probably reflecting a general lack of structured support for scaling startups in Kosovo today.

There appears to be a fundamental understanding of how the entrepreneurial funnel works among the interviewees. They all know that to create more scaleups each ecosystem must generate and support a larger pool of startups. The question is then, why are not more startups growing and entering the scaling up phase?

The reasons for the current disbalance between startups and scaleups are multiple:

- One reason could be the general youth of the Balkan ecosystems. Moving from startup formation to scaling your company takes time and requires constant and consistent access to technical support and financial instruments. At the moment, neither is available to a startup in the Balkans. If and when technical support is available to the entrepreneur, it offers programs around ‘starting a business’ and less so on ‘how to grow your business’.

- Too often, the focus is on supporting entrepreneurs in the idea-stage, and very rarely does a program address scaling companies’ very specific needs.

- A third reason for the disbalance could be linked to access to finance, or rather the limited offer of financial instruments tailored to the needs of scaling startups. Again, the focus is on entrepreneurs in the formation stage who are offered grants (public money) through government and/or donor-funded economic development projects. Instead, Scaling companies need business angel/VC or corporate investments (private capital) to facilitate and support their growth. The lack of private money in the system acts as a Valley of Death for startups in the Balkans.

To improve the balance between startups and scaleups, multiple things need to happen simultaneously. First, public policy actors, such as governments and donor-funded projects, need to spend more resources to boost the entrepreneurial funnel, ensuring a constant flow of new startups.At the same time successful local entrepreneurs should be incentivized to ‘give back’ to the next generation of scaling companies by becoming their mentors and business angels, or even VC investor.