Entrepreneurs can be categorized by their current stage of development. Some are just getting started (idea-stage), others are testing the market with an MVP (early-stage). Some have gone further, are generating revenue, perhaps even investments, and are experiencing growth (scaling stage). No matter where the entrepreneurs are on the journey towards growth, they need support tailored to their current needs. This demand puts pressure on the startup community to deliver quality services. In Brad Feld’s words, the startup community must have continual activities that meaningfully engage the entire entrepreneurial stack.

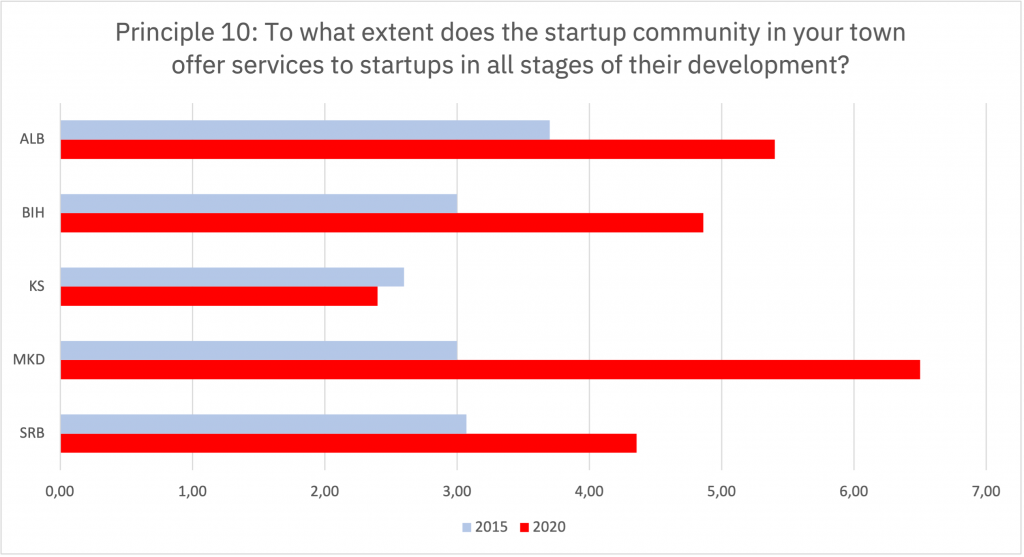

We asked interviewees “To what extent does the startup community in your town offer services to startups in all stages of their development?”

On average, we see a significant improvement (52%) in entrepreneurs having access to services throughout their growth journey. Again, the replies vary significantly from country to country. In three countries, the entrepreneurial stack is clearly improving – Albania (+45%), Bosnia & Herzegovina (+63%) and Serbia (+42%) compared to five years ago. In Kosovo, the opposite appears to be taking place. The score fell by 8% to 2.4 (0 to 10 scale), probably hinting at the lack of support tailored to scaling startups. In North Macedonia the score jumped by a remarkable 117%. Such a result is probably linked to a coherent effort by multiple actors to address the startups’ needs in different stages in their development.

Among the five countries, there appears to be an agreement on four key observations:

- None of the five countries’ startup communities are currently offering continual activities supporting startups throughout the entire entrepreneurial stack.

- There is a lack of consistency and continuity in the supply of financial services and technical support to startups. It is still common that an organization enters the startup support market, runs a program and disappears. The lack of consistency and continuity in the supply service space makes it difficult for entrepreneurs to know where to go for what support at any given time.

- In all countries, most activities appear to target startups in the idea- and early-stages. Some interviewees indicated two reasons for this. One, as an organization, you don’t need much expertise to enter the capacity-building space. Two, these are the stages that international donor agencies focus on and fund.

- Also, there is a common recognition among most of interviewees, in all five countries, that although ecosystems are becoming mature there is still little or no structured support for scaling companies. A few interviewees remarked that there are no scaling startups in their respective countries or if there were, they have left to register and seek investment elsewhere in Europe or the US. For some interviewees, the limited supply of scaling companies was also why there are so few active business angels around. This again sounds like a chicken and egg dilemma. What comes first, scaling and investment-ready startups or access to local smart money (business angels)? Again, the truth is probably somewhere in the middle.

Startup support organizations must make more efforts to deliver tailored technical assistance to scaling startups and improve their investment readiness, while at the same time encouraging and incentivizing local entrepreneurs to become business angels and invest in the next generation of local startups.